This topic is so HOT right now! It also ranks in the top 5 questions I get asked quite often. Since I am both a Cash Home Buyer and a Real Estate Broker I want to share both sides of the story so you’ll have a clear picture as to which one is best for you. Yes, there are some valid points that could make a huge difference in your bottom line. Either path can be the “right” one depending on your priorities: speed, price, convenience, risk tolerance, privacy, and your home’s condition.

Just under one-third of U.S. home purchases were all-cash in 2024 (32.6%), while the rest involved financing—most commonly when a property was listed with an agent and marketed to the widest pool of buyers. Redfin

Let’s dive in where I lay out the real truths, common misconceptions, and the numbers behind each path, so you can make the decision that works best for your situation.

Let’s Start With the Basics

What Does it Mean to Sell to a Cash Home Buyer?

When you hear “cash buyer,” it doesn’t mean someone is showing up with a briefcase full of hundred-dollar bills. It simply means the buyer is using their own liquid funds—not a banks. That could be an individual investor, a landlord, a company, or even another homeowner.

A Cash Home Buyer can offer multiple advantages:

- Speed: Cash deals close fast—7 to 14 days on average—because there’s no bank involved, no underwriting delays, and no appraisal hoops to jump through. Compare that to a financed deal, which usually takes +/- 30–90 days.

- Certainty: Financing is the #1 reason contracts fall apart. In fact, 13% of pending contracts were canceled in March 2025, often because of financing, appraisal, or inspection issues. With cash, that risk is dramatically reduced. Redfin No loan = far fewer fall-throughs tied to financing or appraisal.

- Condition: Most cash buyers purchase homes as-is, meaning you don’t have to make repairs, upgrades, or even clean out everything before closing.

But there’s a trade-off. Studies show cash buyers typically pay less. A UC San Diego analysis found that, on average, cash buyers pay about 10% less than mortgage-financed buyers.

So, you’re essentially trading a little off the top in exchange for speed, certainty, and convenience.

What Does it Mean to Sell with a Real Estate Agent?

On the other side of the spectrum, you have the traditional route: hiring a licensed real estate agent to list your home on the MLS. This is how you maximize exposure to retail buyers. You’ll prep the home, manage showings, weigh offers (cash or financed), negotiate, and navigate inspections, appraisal, and loan timelines.

You pay agent commissions and standard seller closing costs, but you’re competing for the highest market price with the largest buyer pool. National Association of Realtors

Time to contract & closing: Recent NAR surveys show median time on market around 27–28 days in early/mid-2025, then ~30–50 days to close once under contract, driven by mortgage underwriting, appraisal, and documentation. In other words, count on roughly 1.5–2.5 months from listing to closing in typical conditions. National Association of Realtors

Costs: Commissions are the biggest factor. Even after the NAR settlement in 2024, sellers are still typically covering around 5.5% in combined commissions, though this is negotiable. Add another 1–3.5% in closing costs, and you’re looking at an all-in cost of 7–10% in many cases. With elevated home prices sellers are dishing out tens of thousands of dollars to get their house sold.

Bottom line: If your top priority is speed and lower risk of fallout, cash is hard to beat. If you can tolerate a few extra weeks/months for the chance at top dollar, listing with a Realtor may be your best bet.

Net Proceeds (What You Put in Your Pocket)

Cash buyer path

- Price trade-off: Several analysts indicate cash buyers pay less than financed buyers on average because sellers value certainty and speed. A 2024 UC San Diego study found cash buyers paid ~10% less than mortgage buyers, on average (study covers many years of data; local, current results vary). UC San Diego Today

- Fees & repairs: Many investors cash offers are as-is, so sellers often avoid pre-listing repairs and buyer repair requests—costs that can easily hit four or five figures. You’ll still pay normal seller closing costs (title, transfer taxes in some states, etc.), but you typically won’t pay agent commissions if you sell off-market directly. (Standard seller closing costs excluding agent commissions average ~1.8% of the sale price nationally; totals vary by state and local taxes.) Bankrate

Agent-listed path

- Sale price potential: MLS exposure maximizes eyeballs—which can mean more offers and better pricing. Market momentum changes month to month, but as of mid-2025, only ~28% of homes were selling above asking, down from 32% a year earlier—so pricing/strategy matters. Redfin Real Estate News

- Concessions & repairs: About 44% of Q1 2025 sales included seller concessions (e.g., closing cost credits, repair credits), near record highs—so plan for potential give-backs even on the open market. Redfin

- Commissions: Commissions are 100% negotiable. Despite 2024 rule changes after the NAR settlement (greater transparency and requirement for buyers to sign representation agreements), recent data show average combined commissions still orbit ~5.5%, with the buyer-agent slice around ~2.4% in Q1 2025. Who pays what is negotiable; many sellers still end up covering some or all buyer-agent compensation to attract financed buyers. Redfin Clever Real Estate Bankrate The Washington Post

- Other closing costs: Beyond commissions, expect ~1–3.5% for typical seller closing costs (title, taxes, etc.), depending on your state and price point. Many mainstream guides cite ~8–10% “all-in” when you include commissions and closing costs. Bankrate Realtor Zillow

Bottom line: Listing can maximize price but includes marketing time, concessions, and fees—whereas cash often trades price for speed and simplicity.

Side-by-Side Comparison

Here’s a quick table to make the differences crystal clear:

| Factor | Cash Buyer | Listing With an Agent |

| Closing Timeline | 7–14 days (fast) | +/- 45–70 days (listing + financed closing) |

| Certainty | High – no loan fallout | Moderate – 13% of contracts fall through |

| Repairs Needed | Often none, Usually “as-is” | Often required by buyers/appraisers |

| Sale Price | Typically ~10% lower | Higher potential, but may include concessions |

| Commissions | Often none (direct sale) | ~5.5% average (negotiable) |

| Closing Costs | ~0–2% (depending on the cash buyer) | ~1–3.5% |

| Privacy | High – no MLS, no showings | Low – home is publicly marketed |

| Best Fit For | Urgent timelines- auction properties, distressed properties, sellers who value convenience | Sellers seeking top dollar with time to wait |

Common Misconceptions about Cash Home Buyers

Let’s clear up a few myths I hear from homeowners:

“Cash Buyers Always Throw out Lowball Offers”

Cash buyers include: investors, wholesalers, and sometimes an ordinary individual looking to score a deal. Of course this buying sector wants to score a discount, averaging 10-20%, because sellers value speed/certainty, and investors need room for repairs and risks. Hear me out. Mr. Smith has a property he inherited. It has deferred maintenance and back property taxes owed. Mr. Smith cannot afford to fix the property up and pay off the back taxes, so he’ll have to sell this property at a discount. A legit Cash Home Buyers will look at the properties ARV to determine how much they can offer. More on ARV here. Just like every other service industry out there I always recommend my sellers to get at least 3 offers before deciding on one. Yes the offers will vary, but they should be within a healthy range of each other. You as the seller just have to pick the company that you feel works best for you! If you need to hire a plumber for a job, you’re not going to pick the first on you see on the Google. You’re going to check out their website, scroll through reviews, ask around to see if anyone has used them. Well the same principal applies here. Find at least three Cash Home Buyers close by the property and start getting bids!

“Listing My House With a Real Estate Agent Guarantees a Higher Price”

MLS exposure usually maximizes competition, but not every listing fetches top dollar. Your home’s condition, pricing strategy, and the markets momentum are what drives the outcome. With nearly half of sellers giving concessions, in today’s market it’s not just about the list price. Here in Florida the market is leveling out to a buyers market which means more options and negotiating power for the buyer. Sellers on the other hand are having to either sit longer, lower asking price, and give credits/concessions to bait a buyer. If you’re looking to hire an agent to list your home it’s important to get the details of your current market.

MLS exposure usually maximizes competition, but not every listing fetches top dollar. Your home’s condition, pricing strategy, and the markets momentum are what drives the outcome. With nearly half of sellers giving concessions, in today’s market it’s not just about the list price. Here in Florida the market is leveling out to a buyers market which means more options and negotiating power for the buyer. Sellers on the other hand are having to either sit longer, lower asking price, and give credits/concessions to bait a buyer. If you’re looking to hire an agent to list your home it’s important to get the details of your current market.

“Commissions Are Fixed at 6%.”

Commissions now and always have been negotiable. The average right now I’m seeing is around 5.5%, and how it’s split between buyer and seller agents is honestly more confusing than ever after the NAR settlement. It just means having that uncomfortable conversation to see who’s willing to pay who. I have seen some Sellers not willing to pay anything towards the buyer’s reps commission. On the flip side other sellers happy to pay. Bottom line whether you’re a buyer or a seller you need to crunch the numbers to see what you can or cannot afford and have those conversations with the people on your real estate team. Communication is key! It’s always best practice to make sure you get everything in writing. A good real estate agent will present you with a buyers/listing rep contract and cover completely. The Washington Post

“Cash is Always Fastest, Mortgages Are Always Slow.”

My fastest cash deal from contract to close was 4 days. The owner was moving out of state and needed his cash ASAP. We were able to agree on price and terms and boom a deal was struck. The owner got lucky because the title was clean and had no hiccups. Title searches are usually what holds up cash deals. I had a contract on a house up in Seminole County Florida. The owner was elderly and in a hoarding situation. I was dealing primarily with the family to get her out of the house so she could start fresh. Well, title came back and she apparently had over $13,000 in owed utility bills. Blew my mind because I always thought the electric and water company would shut off the supply if you let the bill go long enough. We’ll this particularly lucky lady hadn’t paid her bill in over 4 years! Both utility companies put a lien on her house and clouded the title. Put a wrench in our deal but we eventually worked it out. Mortgages on the other hand usually take anywhere between 30-50 days to close. Just make sure you are using a knowledgeable lender that knows what they are doing. Long story short, yes cash sales are usually quicker, but it’s not a guarantee.

Sell Your Florida House Fast For Cash

We Buy Houses In Florida For Cash. No Repairs Or Fees. Get A Fair Offer And Close In As Little As 7 Days!

Market Reality Check (2024–2025)

- Cash is still a big slice of the market: All-cash buyers were 32.6% of U.S. purchases in 2024 (3-year low, but still elevated vs. pre-pandemic). Monthly NAR reads in summer 2025 showed ~29–31% cash deals depending on the month. Redfin National Association of Realtors

- Time on market is modest but not instant: 27–28 days median DOM recently; bidding wars haven’t disappeared, but they’re less common than the pandemic frenzy. National Association of Realtors

- Concessions are common: 44.4% of Q1 2025 transactions included concessions—buyers again have leverage in many areas. Redfin

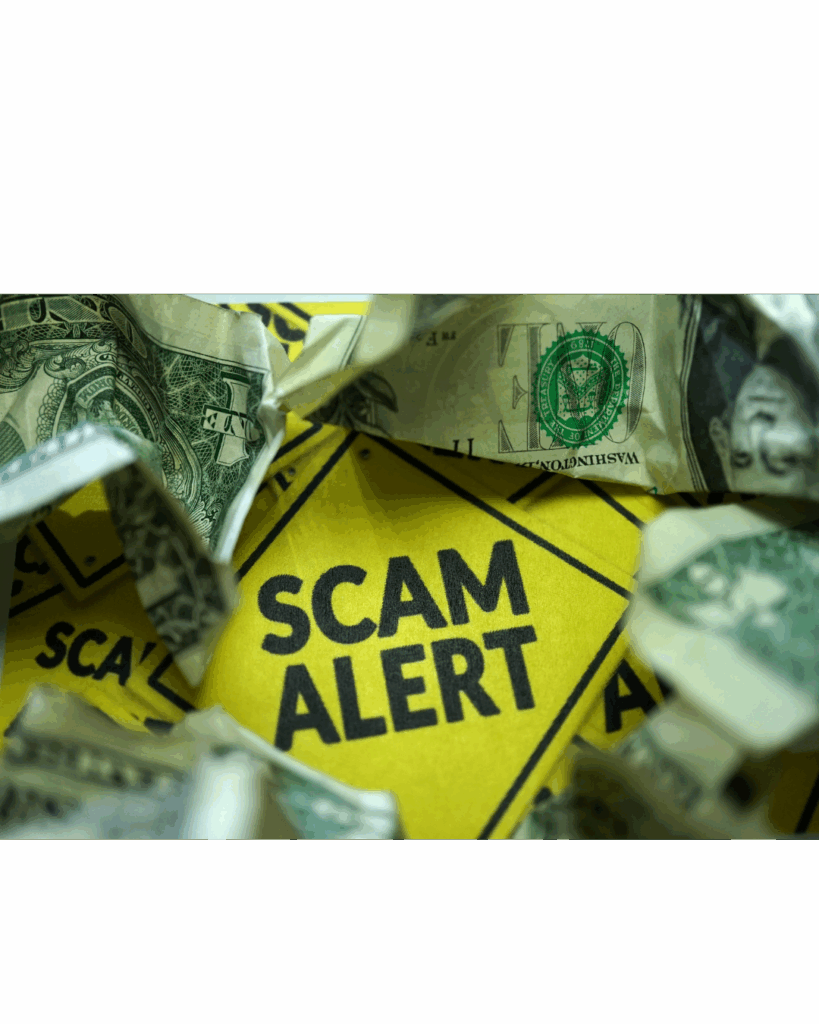

Risks to Watch For: Cash Home Buyers & Selling With an Agent

Cash Home Buyer

- Price anchoring: Some investors present “take-it-or-leave-it” offers anchored low. I have delt with some wholesalers that come back with an even lower offer if we circle back to them and see if they are still interested in placing an offer. As a seller you always want to get more than one bid.

- Proof of funds: Always verify real, liquid funds (bank statement or escrowed funds). Don’t accept vague letters.

- ALWAYS close with a reputable title company or real estate attorney. If a buyer ever says you can close without a title search please run in the other direction, and fast. I’ve had this happen early in my career. Thank god I didn’t listen to the buyer. The owner had a huge IRS lien attached to the property and that lien would have passed to me. So please always ask the professionals you work with if you are unsure on how to proceed with something. They could save you thousands if not hundreds of thousands of dollars.

- Assignment clauses: Some contracts allow the buyer to assign the contract to someone else. Why would anyone want to assign the contract?

- 1) Wholesale. A lot of wholesalers hustle and find motivated sellers. They get the property under contract then sell it to an end buyer. This is legal and if done ethically can be a great way to move property.

- 2) Investors generally do not close in their personal name. Often times they will form an LLC while under contract and then assign that contract to their new LLC. One thing to make sure: When wiring money your buyer must have a bank account already set up in the name of whoever is purchasing the property.

Selling with an Agent

- Appraisal gaps: If the appraisal comes in low, you’ll have to renegotiate price, ask the buyer to bridge the gap, or the deal could fail.

- Concessions creep: Even strong offers later ask for repairs/credits after inspection. Plan a budget and strategy with your agent if this should happen.

- Timeline slippage: Lender delays, HOA docs, title cures, and repairs can stretch closings. Its a great idea to get all parties involved in the closing on the same page so that everyone is aware of important dates. Build a buffer time around hard deadlines (moves, school starts, utility start dates, etc).

So How Do You Decide Which Path to Choose?

There is no right or wrong path. It solely depends on the situation the homeowner is in. An owner in foreclosure may have to choose a cash sale if their house is scheduled for auction and they can’t afford to list with an agent. Another owner who isn’t in distress and is in no rush to sell will most likely to choose to list their house with a realtor. Below are some great questions to ask yourself if you are on the fence.

- What’s my #1 priority—time or money?

- If you must close within 7–14 days with near-zero hassle, a cash offer is going to be the best

- If you can wait 1–2+ months for a shot at top dollar, listing with an agent may be best.

- What’s my home’s condition?

- Heavy repairs, probate/inheritance, hoarding, foreclosure, tenant issues? Cash “as-is” may save you the headaches.

- Turn-key and show-ready? Listing exposes you to retail buyers who might pay more.

- Am I comfortable with public marketing?

- Listing with an agent means photos, online exposure, and multiple showings. Many homeowners don’t want that kind of invasion of privacy.

- Cash is private and has low-traffic typically one showing which is the buyer.

- What are my cost expectations?

- Cash Home Buyer: likely lower price, but fewer repair/holding costs and no agent commissions if sold off-market. Most Cash Home Buyers will even pay your closing costs.

- Listing: higher price potential, plus commissions (~5.5% avg., negotiable) and closing costs (~1–3.5% typical, varies by state). Realtor

Negotiation Tips for Either Path

- Invite competition: Even if you’re leaning towards a cash offer, get multiple offers (from more than one investor).

- Set your “walk-away” number: Know your bottom line net number , not just price—subtract fees, repairs, concessions, and your time/holding costs.

- Verify financing strength (if you list): Prioritize buyers with underwritten pre-approvals, strong down payments, and appraisal-gap plans. (Typical down payments recently hovered near 16% nationally.) Redfin

- Use timelines as leverage: If a financed buyer wants longer inspection periods or lender padding, trade it for a price premium or fewer contingencies.

- Watch the calendar: Rate moves (keep in touch with you lender and ask them to keep you top of mind for any shifts they may see coming), seasonal inventory shifts (this question is for you realtor. They can give you an insight on the market and keep you updated on trends in your area), and local events (school calendars, storms) can nudge demand and your net proceeds.

The Bottom Line

Choose cash if you want speed, simplicity, and certainty, can accept a lower price, and your property needs a lot of work. Choose to list with an agent if you can wait for the market, want maximum exposure and price, and are comfortable navigating showings, inspections, and potential concessions.

If you’re on the fence, get both: line up a couple of verified cash offers and consult a strong local agent for a realistic list-price and net-sheet comparison. Pick the path that maximizes your bottom line after all costs—and best fits your timeline and stress tolerance.

I hope this read has given you a little insight on both paths so you can make a decision that works for you and your family.

About The Author

Jessica is a licensed Real Estate Broker with Acquire Realty Group in the state of Florida. She has been buying and selling real estate since 2006. With almost 20 years of real estate experience she is an investor at heart, specializing in helping homeowners that have distressed properties such as: Tax delinquent, foreclosure, creative financing, probate, inheritance, hoarding houses, liens, and more. All publications are opinion based formed by experience. If you are seeking tax or legal advice it is recommended that you contact a licensed CPA and/or Attorney for your specific needs. If you’d like to learn more about how Particular Properties can help you please click button below!

![companies that buy houses [market_city]](https://image-cdn.carrot.com/uploads/sites/77504/2025/02/Company-That-Buys-Houses-1920x800.jpg)