Homeowners insurance in Florida is absolutely insane right now. If you currently live in Florida and own a house you know exactly what I am talking about. You know you should probably have it, and if you have a mortgage, you’re required to have it. But how much do you know about it beyond that – what it covers (and does not cover), the types of policies, how much coverage you need? What happens in case of minor damage from a storm, or even something as rare as fire damage? Some home owners we have spoken to have excluded “name storms” damage from their policy so they can afford the policy. Some have even elected to not have it at all. If you choose this route and continue not to have insurance longer than 90 days you basically will be “punished” should you decide to get covered down the road. The only carrier that will cover you would be Citizens and they raise the premium for the policy. Definitely do you research prior to electing this type of insurance. If you’re not familiar with insurance carriers reach out to us and we can give you some companies/brokers that we deal with currently and have in the past. To help you out, we’ve put together this homeowners insurance guide for homebuyers in Florida.

Contact Us!

Homeowners Insurance Overview

Homeowner’s insurance is a safety net. It should “compensate you if an event covered under your policy damages or destroys your home or personal items. It will also cover you in certain instances if you injure someone else or cause property damage.”

The three main functions of this insurance are to…

- “Repair your house, yard and other structures.

- Repair or replace your personal belongings.

- Cover personal liability if you’re held legally responsible for damage or injury to someone else.”

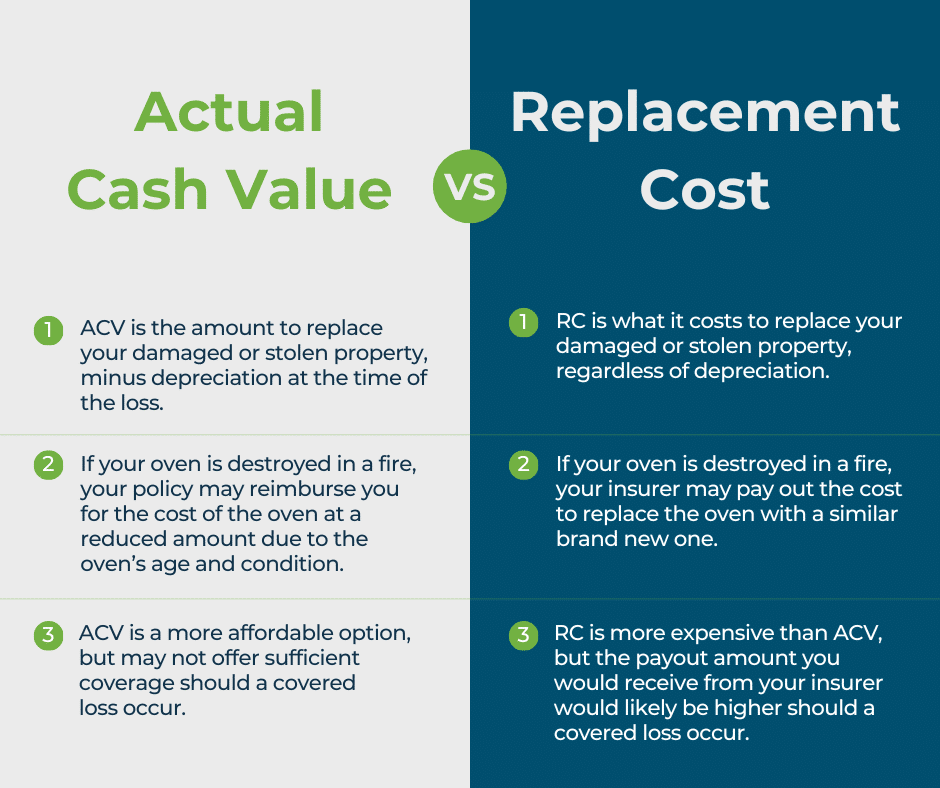

There are three basic levels of coverage with homeowner’s insurance – actual cash value, replacement cost, and extended replacement cost/value. In addition, “policy rates are largely determined by the insurer’s risk that you’ll file a claim.” This risk is assessed on the basis of “past claim history associated with the home, the neighborhood, and the home’s condition.” Insurance carriers also take the homeowners credit into consideration.

Types of Policies

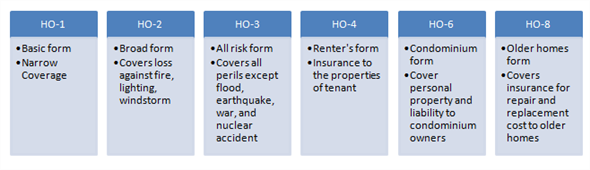

There are several types of homeowner’s insurance (also called “policy forms”), with some providing more coverage than others. The most common policy types are . . .

HO-1 AND HO-2

The least popular policies, provide the least amount of coverage and “payout only for damage caused by issues listed in the policy. Together these two types account for about 8% of homeowners coverage. HO-2insurance, the more common of the two, typically covers your house and belongings only for the 16 [listed] causes . . . HO-1, which isn’t widely available, is the most bare-bones type of homeowners insurance. It covers losses from an even shorter list of perils than the HO-2 form.”

HO-3

“HO-3 insurance policies, also called ‘special form,’ are by far the most common,” accounting for almost 80% of coverage on owner-occupied homes. “If you have a mortgage, your lender is likely to require at least this level of coverage. HO-3 insurance policies generally cover damage to your home from any cause except those the policy specifically excludes, such as an earthquake or flood. However, where it concerns your belongings, an HO-3 policy typically covers only damage from 16 ‘named perils’ unless you buy extra coverage.”

HO-5

Also known as comprehensive form or premier coverage, this type of policy provides the broadest and most extensive coverage. “It pays for damage to your home and belongings from all causes except those the policy excludes by name. . . . It’s typically available only for well-maintained homes in low-risk areas, and not all insurers offer it.”

Sell Your Florida House Fast For Cash

We Buy Houses In Florida For Cash. No Repairs Or Fees. Get A Fair Offer And Close In As Little As 7 Days!

Replacement Cost, Actual Cash Value, and More

You also need to be aware that if your home is destroyed, your homeowner’s insurance company isn’t likely to simply write you a check for the amount listed on your policy. Your payout could differ depending on the cost to rebuild and the coverage you chose – and much of it will be paid directly to contractors rebuilding your home, in many cases.”

Concerning this, here are some things you need to consider when deciding on coverage:

REPLACEMENT COST

This is coverage that will pay however much it takes to rebuild your home(and that may exceed your policy limits). “This situation may arise, for instance, if construction costs have increased in your area while your coverage has remained level.”

ACTUAL CASH VALUE

“Actual cash value coverage pays the cost to repair or replace your damaged property, minus a deduction for depreciation. Most policies don’t use this method for the house itself, but it’s common for personal belongings.”

FUNCTIONAL REPLACEMENT COST VALUE

This type of coverage will pay to repair damage to your home, but possibly with cheaper materials than the original. For example, damage to plaster walls may be repaired with drywall, which is cheaper.

REPLACEMENTCOST VALUE

“Replacement cost value coverage pays to repair your home with materials of ‘like kind and quality,’ so plaster walls can be replaced with plaster. However, the payout won’t exceed your policy’s dwelling coverage limits.”

EXTENDED REPLACEMENT COST VALUE

This type of coverage “will pay out more than the face value of your dwelling coverage, up to a specified limit, if that’s what it takes to fix your home.” This limit is typically a percentage or a dollar amount, but in either case, it provides “a cushion if rebuilding is more expensive than you expected.”

Guaranteed Replacement Cost Value

“Guaranteed replacement cost value coverage pays the full cost to repair or replace your home after a covered loss, even if it exceeds your policy limits.” The catch, though, is that this level of coverage isn’t offered by all insurance companies.

Determining Amount of Coverage Needed

Now, you need to determine exactly how much coverage you need from your homeowner’s insurance. You’ll need enough coverage to rebuild/repair your home in the case that is destroyed or severely damaged. You can estimate the cost to rebuild by multiplying your home’s square footage by per-square-foot local construction costs. YourFlorida agent can also provide some guidance here. Just call(407) 305-9849 to find out more.

What you shouldn’t do is “focus on what you paid for the house, how much you owe on your mortgage, your property tax, or the price you could get if you sell. If you base your coverage on those numbers, you could end up with the wrong amount of insurance. Instead, set your dwelling coverage limit at the cost to rebuild. You can be confident you’ll have enough funds for repairs, and you won’t be paying for more coverage than you need.”

When it comes to your belongings, your personal property, “you’ll generally want coverage limits that are at least 50% of your dwelling coverage amount, and your insurer may automatically set the limit that way.” You can, however, lower the limit or purchase more coverage if you need to/

With respect to the liability limit, experts advise having a “limit at least high enough to cover your net worth,” including “savings, investment accounts, and other assets, minus auto loans, credit card balances, and other debts.”

Cost of Homeowners Insurance

So what does homeowner’s insurance cost? The national average is about $1,600 per year, but this is an average and individual prices can be much higher or lower. In addition, your credit score can also affect the cost of your insurance. Florida insurance has risen year over year. In some markets carriers have left the state completely leaving Florida homeowners confused and frustrated. I’ve seen some of our policies double on some of our properties.

And then there’s the deductible – the amount you have to pay out of your pocket before the insurance kicks in. Here are the two main things to keep in mind when choosing your policy’s deductible:

- A higher deductible will reduce your premium, but you’ll pay a lot more when you file a claim.

- With a lower deductible, you’ll pay a higher premium, but will pay a lot less out of your pocket for a claim.

When It’s Time to Buy

Ultimately, homeowners insurance isn’t a luxury – it’s a necessity. But there are so many influencing factors and available options, it’s difficult to know what kind of policy and coverage is right for you. An experienced Florida agent can provide valuable assistance in many of these areas. We suggest that Florida home buyers trying to untangle the homeowner’s insurance puzzle, contact us today at (407) 305-9849.

Contact Us

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.

Summary for Homeowner Insurance In Florida

Choosing homeowner’s insurance in Florida requires careful consideration due to the unique risks associated with living in the state, such as hurricanes, floods, and other weather-related events. Below is a step-by-step guide and review to help you with homeowner’s insurance in Florida:

- Understand Your Needs: Assess the specific risks associated with your location. Consider factors such as proximity to the coast, flood-prone areas, and historical weather patterns in your region. Your local property appraiser website is a great resource to use when trying to find out information on a specific parcel.

- Coverage Options: Familiarize yourself with the different types of coverage offered by homeowner’s insurance policies. This typically includes dwelling coverage (for your home’s structure), personal property coverage (for your belongings), liability coverage (for legal expenses if someone is injured on your property), and additional living expenses coverage (for temporary housing if your home becomes uninhabitable).

- Hurricane and Windstorm Coverage: In Florida, it’s crucial to have coverage for hurricane and windstorm damage. Make sure the policy you choose includes this coverage, as it’s often sold separately from standard homeowner’s insurance.

- Flood Insurance: Standard homeowner’s insurance policies usually don’t cover flood damage. Since Florida is prone to flooding, especially during hurricane season, consider purchasing a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer. While Flood is currently not required to have here in Florida, it will depend on your flood zone and the structures proximity to water.

- Replacement Cost vs. Actual Cash Value: Understand the difference between replacement cost and actual cash value coverage. Replacement cost coverage will reimburse you for the cost of replacing damaged items with new ones, while actual cash value coverage takes depreciation into account. For a visual refer to the images above. If you need more clarity I recommend reaching out to a local Insurance agent.

- Deductible: Decide on a deductible amount that you’re comfortable with. A higher deductible will result in lower premiums, but you’ll pay more out of pocket in the event of a claim.

- Shop Around: Obtain quotes from multiple insurance companies to compare coverage options and premiums. Consider working with an independent insurance agent who can help you navigate the different policies available. I personally choose to work with an independent Insurance broker. One that can shop several companies for a competitive price.

- Financial Strength and Reputation: Research the financial strength and reputation of the insurance companies you’re considering. Look for companies with high ratings from independent agencies like A.M. Best, Moody’s, or Standard & Poor’s. This is pretty important here in Florida. Many companies have up and left the market place and in return have left homeowners scrambling to find another company. When this happens you are typically required to get a 4pt inspection and a home inspection prior to getting new coverage. It truly is a hassle for homeowners right now. So be sure to interview what company you are looking to go with and don’t be shy about asking your questions!

- Discounts: Inquire about available discounts that could lower your premium, such as bundling your homeowner’s insurance with other policies, installing security features in your home, or having a claims-free history.

- Read the Fine Print: Carefully review the terms and conditions of the policy, including any exclusions and limitations. Make sure you understand what is and isn’t covered before purchasing the policy.

- Review Annually: Periodically review your homeowner’s insurance policy to ensure it still meets your needs. Update your coverage as necessary based on changes to your home or personal circumstances.

ABOUT THE AUTHOR

Jessica is a licensed real estate broker in the state of Florida. She has been buying and selling real estate since 2006. She is an investor at heart. She specializes in helping homeowners dealing with distresses properties such as: Tax delinquent, foreclosures, creative financing, probate, inheritance, hoarding, liens, and more. All publications are opinion based formed by experience. If you are seeking tax or legal advice it is recommended that you contact a licensed CPA and/or Attorney for your specific needs. If you’d like to learn more about how Particular Properties can help you please click button below!

We Buy Houses In Florida!

Particular Properties is your Central Florida Cash Home Buyer. We have been buying real estate since 2006. Currently we operate in the following cities: Altamonte Springs Beverly Hills Brooksville Casselberry Citrus Springs Cocoa Crystal River Homosassa Homosassa Springs Inverness Lecanto Longwood Orlando Oviedo Rockledge Sanford Spring Hill and Titusville

Our market space is constantly expanding! If you do not see your city listed please Contact Us and let us know where you are located. We’d love to hear from you! Want to jump ahead and fill us in on your property info? Click here to fill out to receive your Cash Offer!

Florida’s Trusted Cash Home Buyer

We have been buying, selling, fixing, and flipping real estate since 2006. Over the years we’ve worked with and helped homeowners with all kinds of situations sell their house or property. Whether its a divorce, foreclosure, inheritance, hoarding, or deferred maintenance we can tackle it. Our priority is to find a solution that best fits your needs. Click below to get your free consultation!

![companies that buy houses [market_city]](https://image-cdn.carrot.com/uploads/sites/77504/2025/02/Company-That-Buys-Houses-1920x800.jpg)